James Taulman is an experienced stock analyst and trader who has specialized in the CAN SLIM® investment strategy. He runs a service for swing traders, where he provides real-time buy/sell notifications, market analysis, and personalized coaching. Taulman has over 25 years of experience in identifying high-potential stocks, helping both professional money managers and private investors. His services include stock video updates, educational lessons, and direct support during trading hours.

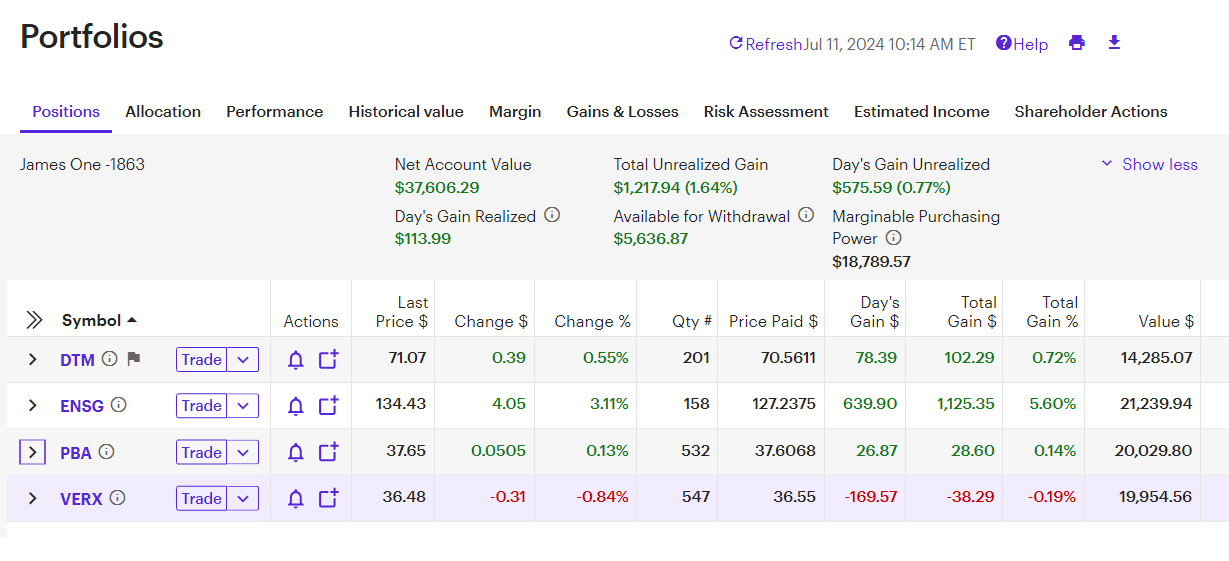

Recent Portfolio Snapshot – 7/11/24

Sign up Today and Start Receiving…

- REAL-TIME BUY/SELL NOTIFICATIONS VIA TEXT/SMS

- DIRECT TEXT/SMS LIVE SUPPORT DURING THE TRADING DAY

- STOCK VIDEO UPDATES ON CURRENT BUYS/SELLS

- 1-ON-1 COACHING & PHONE CONSULTATIONS

- EDUCATIONAL LESSONS ON MARKETS/TRADING/STRATEGY

I’ll Text You High-Quality Stocks That Looked Poised to Make Sharp-Quick Moves

You Will Know Exactly When I am BUYING them and then SELLING them.

Don’t Miss My Next SwingTrade. Get Started Today!|

SIGN UP HERE

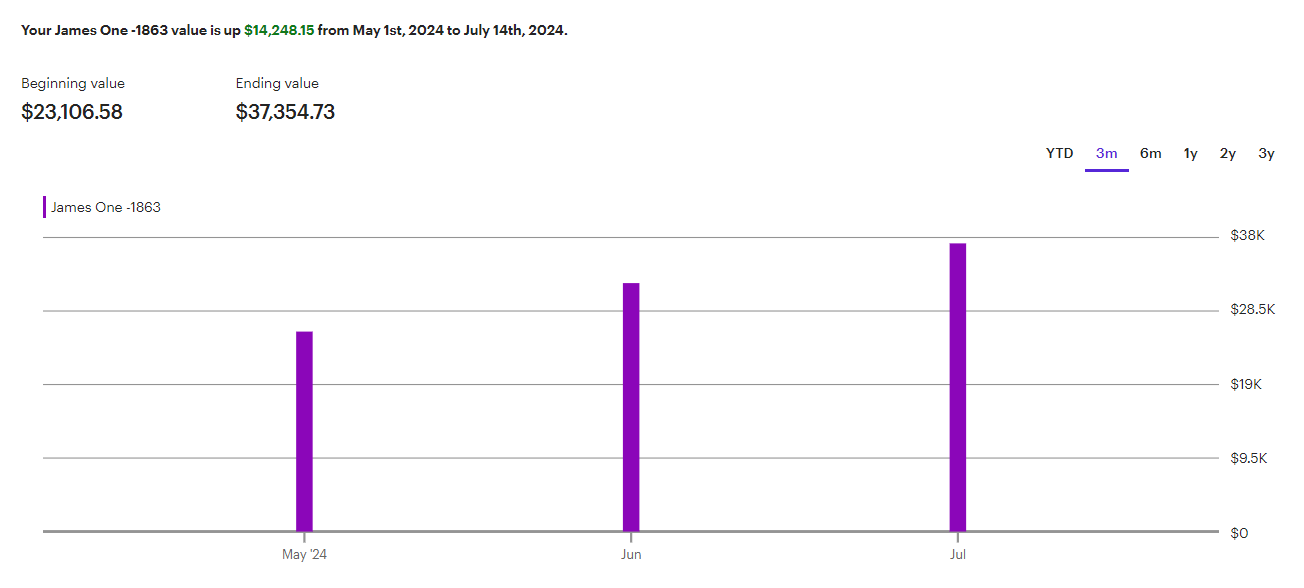

Check Out My Recent Account Performance +54%

UPDATED: 7/15/24

*This is a screenshot from my actual trading account.

*This is a screenshot from my actual trading account.

Don’t Miss My Next SwingTrade. Get Started Today!|

SIGN UP HERE

How it Works… and all that is included.

1) REAL-TIME BUY/SELL NOTIFICATIONS VIA TEXT/SMS

Get my personal real-time BUYS, ADDS, SELLS, SHORTS, COVERS as I am making real-money trades.

Below are screenshots of the SMS messages you will be receiving once you sign up.

You will be able to reply to any of these SMS messages and ask me any questions you may have.

Don’t Miss My Next SwingTrade. Get Started Today!|

SIGN UP HERE

2) DIRECT TEXT/SMS LIVE SUPPORT DURING THE TRADING DAY

Receive on-going direct access to me via text, email, or phone

Text directly with me anytime you have a question or concern.

Don’t Miss My Next SwingTrade. Get Started Today!|

SIGN UP HERE

3) STOCK VIDEO UPDATES ON CURRENT BUYS/SELLS

I produces regular video updates on all current postions and more. Watch them right on your phone.

Don’t Miss My Next SwingTrade. Get Started Today!|

SIGN UP HERE

4) 1-ON-1 COACHING & PHONE CONSULTATIONS

Get an Initial 30 min+ Phone Consultation

– Schedule your 30 min+ phone appointment anytime.

– Discuss your trading / investing style

– Ask any questions about the service, market, individual stocks, etc.

Get You Initial Phone Consultation with me for FREE with Your 2-Week Trial Today.

SIGN UP HERE

5) EDUCATIONAL LESSONS ON MARKETS/TRADING/STRATEGY

I produces regular educational videos that you can watch right on your phone.

Education in the Market is Key to Your Success. Start Learning Today.

SIGN UP HERE

DISCLAIMER: James Taulman is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities or currencies customers should buy or sell for themselves. The independent contractors and employees or affiliates of Company may hold positions in the stocks, currencies or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities and/or currencies. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results. Factual statements on the Company’s website, or in its publications, are made as of the date stated and are subject to change without notice. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable or that they will not result in losses. Past results of any individual trader or trading system published by Company are not indicative of future returns by that trader or system, and are not indicative of future returns which be realized by you. In addition, the indicators, strategies, columns, articles and all other features of Company’s products (collectively, the “Information”) are provided for informational and educational purposes only and should not be construed as investment advice.